Claimed Private Option savings doesn’t withstand scrutiny

Claimed Private Option savings doesn’t withstand scrutiny

Guest Article by David Ferguson

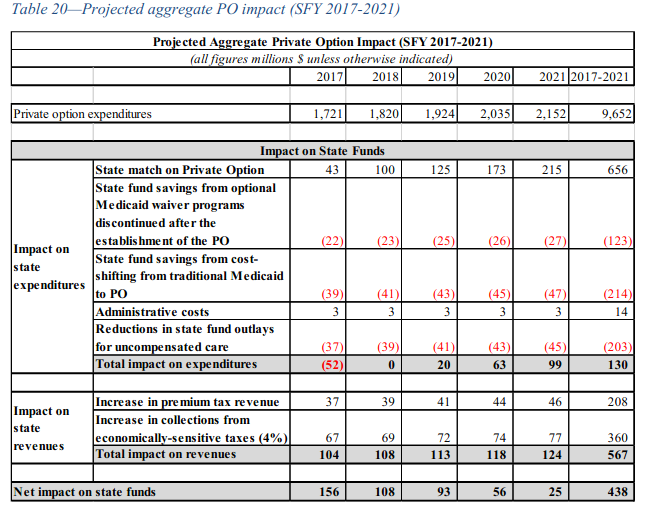

Obamacare supporters claim by continuing Arkansas’ massive government entitlement program the Private Option, Arkansas will save $438 million during the years 2017 through 2021. Yes friends expanding government is supposed to save (not cost) money.

Obamacare supporters claim by continuing Arkansas’ massive government entitlement program the Private Option, Arkansas will save $438 million during the years 2017 through 2021. Yes friends expanding government is supposed to save (not cost) money.

The claim of savings comes from a report by the consulting firm, The Stephen Group. The report says during the period of 2017-2021 the state will have expenses of $670 million ($656 in federal match, plus $14 million in administrative costs). Then the report cites factors that are claimed to save Arkansas more than $1.1 Billion over the same period and result in Arkansas getting to pocket a profit of $438 million.

The media and politicians accepted this number without question. If the claim were true, Arkansas government would be receiving $1.65 for every dollar the state spends. You know the old adage, “If it sounds too good to be true, it probably is.”

I think the numbers actually are “too good to be true.” Instead of saving the state money, I think the numbers still show Arkansas having to pay hundreds of millions of dollars at a time when the state budget is already under significant stress and various groups want to raise taxes.

Why is the report so overly optimistic? Consider this:

- The Stephen Group was required by its contract with the state to produce a pro Obamacare Medicaid Expansion report.

- Even if you were to accept the report’s claim of saving, the time period examined by the study is skewed so that it only includes one year when Arkansas’ share of the costs will increase to ten percent, while the other four years are at a lower matching rate.

- In trying to come up with savings, everything, including the kitchen sink, was thrown in and much of the alleged savings is questionable at best.

The claim of a saving has been seen by some as an opportunity for Republican supporters of the Obamacare program to justify supporting it. Without the alleged savings their votes on this optional Obamacare program come down to whether they like the big government policy or not. The Private Option provides insurance to the Obamacare Medicaid expansion population, which is overwhelmingly able bodied working age adults (40%-46% not working) with no dependents, meanwhile some disabled persons are put on waiting lists for assistance.

Overview of the claim of savings

Let’s look at the Stephen Group’s chart claiming a saving to the state from the expansion of government through continuation of the Private Option (Obamacare Medicaid Expansion). Then we can discuss the many problems with the numbers.

Contract required a pro Obamacare Medicaid Expansion report

The first thing you need to know about the projection of savings in the Stephen Group report is the contract directed the consultants to prepare a report supporting Obamacare Medicaid Expansion. Here is what the Stephen Group said about its contract with the Health Reform Legislative Task Force:

TSG’s [The Stephen Group] contracted responsibility calls for recommendations to improve the quality and efficiency of the traditional Medicaid program while offering a solution for the future of the Private Option, while maintaining coverage for the nearly 250,000 participants in the program. [i](Emphasis Added)

“Program” as used above means Obamacare Medicaid Expansion (which in Arkansas is currently called the “Private Option.”)

The contract terms should not be a surprise considering the task force was created in a way ensuring Private Option supporters would control the result. Nine of the 16 members voted for the Private Option when it was passed in 2013. (Two other members of the task force were not even in the legislature in 2013.) Fourteen of the 16 members voted for the task force legislation which did not cut short the Private Option by even one second and gave the task force the duty to recommend a way to continue Obamacare Medicaid Expansion.

Results skewed by limiting which years are examined

Even if you were to accept the Stephen Group estimates (which I do not), you can readily see the alleged savings drops dramatically from $156 million in 2017 to $25 million in 2021. By focusing on a five year period starting in 2017 when the state contribution is 5%, the report only includes one year when the state contribution is 10%. By cutting the table off once you reach the more costly years you skew the results to make it appear more favorable.

As you will see below there are problems with even the projection of a saving of $25 million in 2021.

Factors used in the alleged savings?

- Factor: Increase in collections from economically-sensitive taxes.

Eighty three percent of the savings claimed can be attributed to: “Increase in collections from economically-sensitive taxes (4%).” Sounds important but do you know what this means? It means that by spending lots of federal and state tax money on the Private Option, the program will stimulate the economy and bring in additional tax money for Arkansas – taxes such as the income tax, sales tax, etc.

In essence the argument is: GROWING GOVERNMENT AND GROWING GOVERNMENT INVOLVEMENT IN YOUR LIFE IS THE WAY TO PROSPERITY. It is surprising to hear this argument being made when Arkansas’ state government has a Republican majority. The argument sounds more like one you might expect liberals to make.

It is disturbing to see a government entitlement program being justified as if it was an economic development project. Think about this. If you accept the idea that entitlements can be justified as if it is an economic stimulus package, then you would also say these things are also economic stimulus packages:

- Waiving work requirement for receiving Food Stamps and thereby growing the percentage of Arkansas’ population that is dependent on OUR federal money.

- Freely spending General Improvement Funds without oversight or priorities.

- Imposing Common Core on our children, because it not only brings OUR federal money to the schools, but also because of economy stimulation and resulting state tax revenue.

- Leaving loopholes in the ethics laws so lobbying interests can buy every meal for groups of legislators – great for restaurants and catering businesses.

- Raising salaries of legislators, the governor, and other state constitutional officers – they pay taxes too.

- Yes, you could include everything the government does, from basic things like building prisons to ridiculous wastes of money like the spending of tax money on benefits for out-of-state residents and dead people.

The beauty of the stimulus argument for Obamacare supporters is – There is no way to verify their claims of tax revenue growth. If the economy goes up for any reason at all, Obamacare supporters can say “Oh the Private Option is responsible for $438 million of that growth.” If the economy goes down, Obamacare supporters can say, “It is a good thing we have the Private Option otherwise the downfall would have been worse.”

Let’s not forget:

- The idea of a savings is also flawed because it is based on a major expenditure of federal money in Arkansas. As federal taxpayers we pay for that too!

- There is NO bucket of federal money that will be spent in another state if Arkansas doesn’t keep Obamacare Medicaid Expansion. The money doesn’t come from some nameless person in Vermont or California. We are federal taxpayers too and for generations we will be paying for the money the United States has already borrowed in its $18.5 Trillion

- Instead of the Obamacare Medicaid Expansion (Private Option) being some kind of economic stimulus package, it is quite the opposite. It is a disincentive to work. According to census data, the majority of enrollees are able bodied working age adults with no dependents. However, estimates indicate that 40% to 46% of enrollees do not work (not part-time, seasonal or even part-time during a season – just don’t work.)

Even if you accepted the liberal ideas that bigger government means prosperity and that entitlements can be treated as if they were an economic stimulus package, the 4% model is just a generic number based on Arkansas general revenues and does not reflect the health care and insurance industries. It certainly does not take into consideration that hospitals are largely tax exempt, or that hospitals and insurance companies might choose to use the extra taxpayer money to shift profits to operations in other states.

The claimed $360 million saving through “Increase in collections from economically-sensitive taxes (4%).” is little more than liberal big government wishful thinking.

- Factor: Reduction in state fund outlays for uncompensated care.

The report claims Arkansas will save $203 million over five years by reducing state funding for uncompensated care. The report says: “as a consequence of the PO, some direct spending on uncompensated care was removed from the state budget”[ii]

So what was the state spending? I did not find any appropriations of general revenue for uncompensated care. All I found was a few appropriations of General Improvement Funds (GIF) for Community Mental Health Centers.

GIF is one time grant money that is classified as surplus and GIF expenditures depend on how much surplus is available. GIF is normally appropriated once in each two-year cycle. There are the appropriations found:

- 2011 – $4 million (Act 854 of 2011)

- 2012 – $7,766 of the 2011 grant was reauthorized for spending (Act 82 of 2012)

- 2013 – $15 million (Act 738 of 2013). Plus $7,766 of the 2011 grant was reauthorized for a second time and indicating it still hadn’t been spent (Act 164 of 2013)

- 2014 – $7,766 of the 2013 grant was reauthorized for spending. (Act 233 of Fiscal Session 2014)

- 2015 – $7,766 of the 2013 grant was once again reauthorized for spending. (Act 811 of 2015)

Spending $4 million or less over a two year period, and then $15 million or less over another two-year period, with both being one time surplus money is a far cry from the Stephen Group projection of spending between $37 million and $45 million per year.

Based on the appropriation acts I found, I can only assume the projection of uncompensated care spending has been inflated by 4 to 6 times and is based on General Improvement Fund appropriations which are surplus money and not part of a regular budget.

NOTE: When a medical provider refers to “uncompensated care” it doesn’t mean they spent that amount of money. It is a pie-in-the-sky number for desired profits. For hospitals only a small percentage of the claims of uncompensated care have anything to do with charity care for the poor. [iii]

- Factor: State fund savings from cost-shifting from traditional Medicaid to PO

The report claims Arkansas will save $214 million over five years from shifting costs from the traditional Medicaid program to Obamacare Medicaid Expansion (Private Option). The theory behind this number appears to be that the state saves money by moving people into Obamacare Medicaid Expansion instead of traditional Medicaid since the state is responsible for a smaller percentage of the cost under Expansion.

There is a problem with this notion. Federal law prohibits states from moving people eligible for traditional Medicaid into the Expansion.[iv] Medicaid Expansion is for people who are “newly eligible” under Obamacare Medicaid Expansion and is not for those who would be eligible under traditional Medicaid. It appears the $214 million savings should instead be zero.

- Factor: State fund savings from optional Medicaid waiver programs discontinued after the establishment of the PO

The report claims the Private Option will save the state $123 million because Arkansas no longer has some optional Medicaid waiver programs that were discontinued under Obamacare. It is my understanding those wavier programs do not come back even if Arkansas no longer participates in Obamacare Medicaid Expansion. If the programs would not come back, you can’t count them as Private Option savings. Therefore, it appears this savings claim would instead be zero.

- Factor: Increase in Premium tax revenue.

The report claims the Private Option will generate $208 million in state revenue from increased insurance premium tax revenue. This item actually reduces Arkansas’ overall cost, but Private Option supporters may wish this scheme had not been included in the list.

Arkansas takes Obamacare Medicaid Expansion under Obamacare Medicaid Expansion rules and purchases insurance for the benefit of enrollees. Arkansas then turns around and charges the insurance companies an insurance premium tax on the Private Option policies the state bought.

The scheme allows Arkansas to shift a substantial portion of the required state match to the federal government. The insurance companies pass on the higher cost of doing business in the form of premiums on the Private Option policies, but most of the higher costs gets picked up by the federal government. (The federal government is responsible for all the cost now, 95% in 2017 and reduced to 90% in 2021. This leaves the federal government holding the bag for a higher costs while both Arkansas and the insurance companies pocket money. The scheme generates about a third of Arkansas’ required match.

Before you say “Yee Haw! We pulled one over on that dad-blamed federal government,” remember you are also a federal taxpayer and it still comes out of your pocket whether as state taxes or federal taxes.

Will the federal government allow this scheme to continue to put money in Arkansas’ pocket while causing higher overall program costs? This is a serious issue. Without this scheme, the concept of running the Obamacare Medicaid Expansion program through insurance companies crumbles.

The federal Centers for Medicare and Medicaid Services (CMS) has not been vigilant in making states pay their share, however the federal Government Accounting Office (GAO) has already shown it will be vigilant concerning CMS overspending. How about some dedicated public official asking the GAO if it is allowable for Arkansas to cause a higher program cost, nearly all of which must be paid by the federal government, in order to reduce the state’s effective match.

Bottom line

- We were told the Private Option was not Obamacare Medicaid Expansion – but it is.

- We were told we could pull the trigger to end the Private Option anytime—but they now say we cannot.

- We were told Arkansas’ share of a pot of money would go to another state if we didn’t pass Obamacare Medicaid Expansion – but there is NO pot of dedicated money.

- We were told the Private Option could not be an entitlement program – but Medicaid by definition is an entitlement program.

- We were told the Private Option is for working families – but it is overwhelmingly for able bodied working age adults (40%-46% not working) with no dependents.

- We were told Arkansas could use INNOVATION and CONSERVATIVE TWEAKS to make a liberal program into one of conservative values – it doesn’t.

- We were told the Act creating the Health Reform Legislative Task Force ends the Private Option – but it didn’t advance the end date by even one second, and the first duty of the task force is actually to recommend a way to continue Obamacare Medicaid Expansion.

- We were told the consultants would give us the answer – but the consultants were directed to make recommendations for continuing Obamacare Medicaid Expansion.

- We were told Arkansas would save $438 million over five years by keeping the Private Option – but all I see is lots of costs and no savings.

The attempts to put a conservative spin on the Obamacare Medicaid Expansion program (adopted by congress with only Democrat votes) just haven’t worked.

[i] The Stephen Group: Volume 1 Executive Summary – 2. EXECUTIVE SUMMARY VOLUME II

[ii] The Stephen Group: Volume 1 Findings (amended to include all Appendix references), October 1, 2015 (released October 7, 2015) Page 46

[iii] Healthcare in Arkansas….the bottom line

[iv] 42 U.S. Code § 1396d (y)