But That Is the Way Budgeting Has Been Done

High Spending & Lack of Accountability

High Spending & Lack of Accountability

Arkansas’ budget process is designed for growth in government spending which makes Arkansas a high tax state and a high spending state. The process fails to eliminate or reduce the least effective, least needed, and most wasteful state government programs.

For decades the Democrats controlled Arkansas state government. Their idea of control was to grow government, spend more, and never look back.

Every two years the legislature passes some tax relief legislation and brags about it, but we will remain a high tax state and a high spending state as long as the state spends money just because it spent it in the past.

Here is the fatal flaw in the Democrats’ Arkansas budget plan (which the Republicans inherited). The starting place for the next year’s budget begins with them determining how much money the agency got in the previous year, and then asks two questions:

- What percentage budget increase should ALL agencies get for the next year?

- Should the agency get extra money in addition to the across the board increase?

The plan doesn’t ask:

- Do we need this specific program anymore?

- Is the program meeting its goals?

- Is there a better way?

- Is the agency wasting money and needs to tighten its belt, so it will not spend money unwisely?

Enter the Republicans

In 2013 the Republican Party became majority party in the legislature, but there was a strong Democrat Governor. When the new Republicans were sworn in, many of the budget decisions had already been made and the budget process didn’t change.

Since 2015 Republicans have had a large majority in the legislature and the state has a Republican Governor. Still the same system of budgeting continues unchanged from Democrat days.

Despite the Republican principles of limited government and lower taxes, the Republicans have continued the Democrats’ system of budgeting. The Republicans have tried to hold down the across the board increase for agencies, but this still rewards bad wasteful programs because no evaluation is done and the problem is not addressed.

Some Republicans campaign on running Arkansas government like a business, but do you know of any business that blindly increases what it spends on every division of its operation? No, a successful business will evaluate what it needs to spend on each division and decide where changes in operation are needed. This is what must be done in state government. Just because it is taxpayer money, not your own money, is no reason to let millions be flushed down the toilet.

It Has Always Been Done That Way

Republicans have fallen into the trap of doing bad budgeting because – that’s the way it has always been done.

Budget hearings will start in October and it will be the same ole Democrat budget process because no agency evaluations have been done.

Rocking The Boat Is Bad For Reelection

In any event, many politicians are unlikely to have the stomach for real budget evaluations. Much of state spending is supported by special interests, lobbyists, and government contractors, whose support is necessary to get reelected. It is easier to do what is expedient instead of what is right.

Another Fine Mess You Got Us Into

What is the result of Arkansas failing to do performance-based budgeting and cost accounting?

- Arkansas is ranked as a high tax state.

- Arkansans pay more per person for state government than people in most other states.

- All this despite Arkansas being a poor state.

High tax state

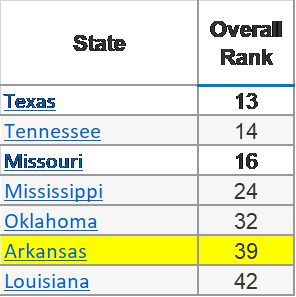

Arkansas ranked as a high tax state in the 2018 State Business Tax Climate Index by the Tax Foundation. Thirty-eight

states ranked better than Arkansas and only eleven states ranked worse. The tax rates in five of the six surrounding states were better than the tax rates in Arkansas.

Tax Burden Per Person

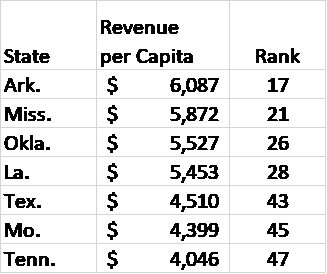

The tax burden per person in Arkansas is high when compared to other states. The Tax Foundation says Arkansas is the seventeenth highest state in the nation. Taxpayers in all six surrounding states pay less per person. The report is based on the 2014 fiscal year and appears in Facts & Figures 2017: How Does Your State Compare? It is Table 5 -State Revenue Per Capita.

Below is Arkansas’ high tax compared to the surrounding states.

Low income state

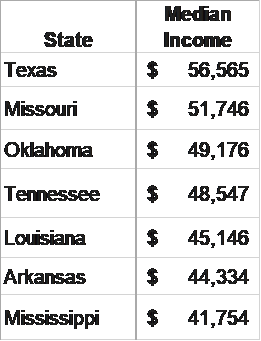

According to the Census Bureau only West Virginia and Mississippi have a lower median household income than Arkansas.

Stop Budgeting The Democrat

Tax & Spend Way!

Will your State Representative and State Senator stand up for taxpayers?

The Arkansas legislature needs to be better stewards with your tax money. We need performance-based budgeting and activities based cost accounting! The legislature needs to define the mission of every state agency and every state program and be able to define when it is hitting the mark and when it is not.