Highway Commission alerts drivers to hazards of over 50 highway projects, while pushing higher taxes for more construction.

Did you see a recent article saying there are more than 50 highway construction sites in Arkansas? Meanwhile, the State Highway Commission, Governor Asa Hutchison and his allies in the legislature want to raise gasoline and diesel taxes because they say there isn’t enough money for highway projects.

The article appeared in many local newspapers as an update from the Arkansas House of Representatives or from your local state Representative. Some Representatives posted the article on their Facebook pages. The article begins this way:

LITTLE ROCK — There are currently more than 50 highway construction projects taking place state wide. Work zones can be found in every corner of the state.

Highway work zones can be potentially dangerous for motorists who drive through the complex array of signs, barrels, and lane changes, and for workers who build and maintain our streets, bridges, and highways. This is why we want to direct your attention to a website and app that could help you find alternate routes this summer.

The Arkansas Highway and Transportation Department (AHTD) is constantly updating idrivearkansas.com. You can also find the IDrive Arkansas app in the app store for your smart phone.[i]

When you look at the main page of the Arkansas Highway and Transportation Department the first thing you will see is a long list of alerts to drivers about highway construction projects across the state. To supplement the information, they have the I Drive Arkansas website and app to help drivers with the many construction projects.

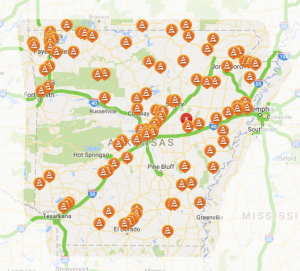

Look at the IDrive Arkansas map of highway construction projects. No wonder they think you need an app for your smart phone to try to avoid construction zones.

Look at the IDrive Arkansas map of highway construction projects. No wonder they think you need an app for your smart phone to try to avoid construction zones.

Look at the map again and ask yourself these questions: How many more road projects should Arkansas taxpayers be paying for at one time? How much more should you be taxed for highways?

The Governor and many legislators wanted to put on the ballot an issue to approve the issuance of highway bonds, BUT their plan was to deceive voters by not telling voters a vote “FOR” would trigger an automatic increase in gasoline and diesel fuel taxes. The bill, HB1726, was part of a two-bill plan to increase taxes by $217.2 million.[ii] The bill received more than a majority vote in the state House of Representatives but failed because the bill required a 2/3rds vote.

The State Highway Commission is still trying to get higher taxes on the ballot and is trying to drum up support for a ballot initiative. The State Highway Commission is sending mixed messages. On the one hand, they want you to know there are so many highway construction projects that you should use their app or website to help you avoid construction zones. On the other hand, the Highway Commission, the Governor, and many legislators are in a hurry to get more of your money in the form of taxes for highways.

Did your state Representative vote for the plan that would raise taxes? Here is a link to the last official vote in the House of Representatives – HB1726 vote.

[i] http://couriernews.com/pages/full_story/push?article-LITTLE+ROCK+-+There+are+currently+more+than+50+highway+construction+projects+taking+place+state+wide%20&id=27435829

[ii] Passage of both HB1726 and HB1727 would have been necessary for the tax plan. This is the link to the Fiscal Impact Statement for HB1727 – http://www.arkleg.state.ar.us/assembly/2017/2017R/Fiscal%20Impacts/HB1727-DFA1.pdf