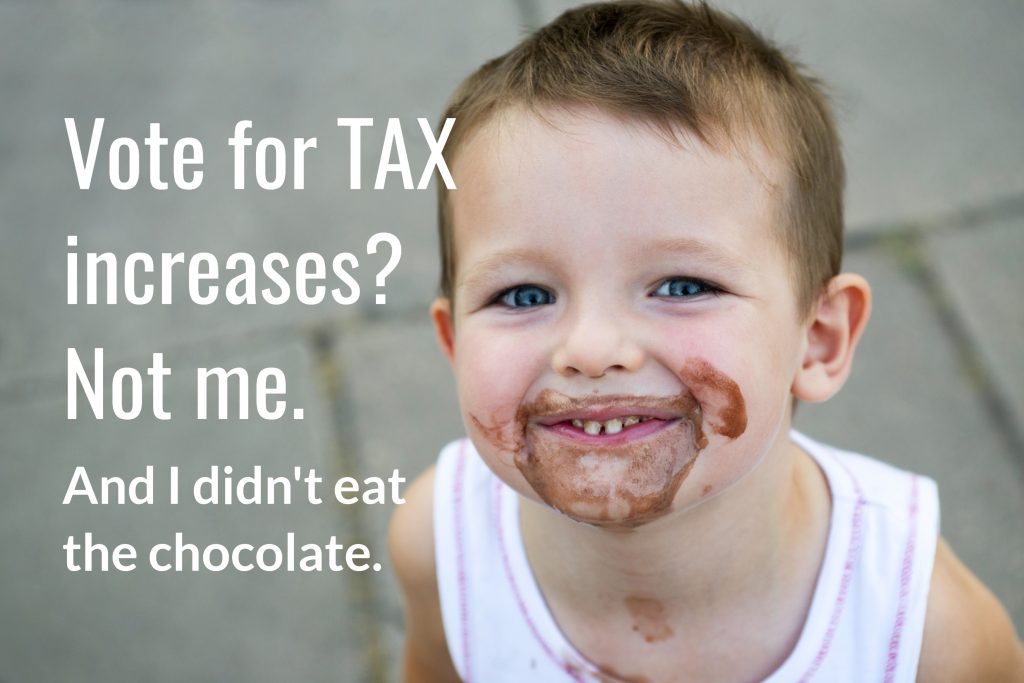

I didn’t eat the chocolate or vote for tax increases

Update 6/16/2017: Corrected citations to gas tax bills.

Earlier this year the Arkansas legislature considered several bills to increase your taxes. Some passed and some failed. We looked at four high profile tax bills and found one thing they all had in common. In each, Republican politicians claimed they weren’t really increasing your taxes. Yet it was going to cost you money.

Hearing their excuses, we couldn’t help but think of a little boy, chocolate across his face, denying he ate the chocolate cake.

Here are some of the tortured arguments they used to claim their tax bills were not tax increases:

- The overall plan is revenue neutral (even though your tax will go up to fund someone else’s tax break).

- We called it a “fee.”

- There is an existing tax that has never been enforceable on these transactions.

- We are only authorizing the voters to pass the tax, but not telling them that is what their vote will do.

I. CLAIM: It’s not a tax increase because the overall plan is revenue neutral (even though your tax will go up to fund someone else’s tax break).

House Bill HB1162 (Act 141) by Representative Charlene Fite gave an income tax exemption to military retirees for their military retirement pay. All or nearly all legislators favored giving a tax exemption to military retirees. The problem was the bill also increased other taxes to offset the impact on state revenue.

The bill included a tax break for military retirees and a tax break for manufacturers of soft drinks, but the bill increased the sales tax on candy and soft drinks, imposed a sales tax on digital products and digital downloads, and imposed the income tax on unemployment compensation.

It was claimed the tax cuts and tax increases exactly balanced out to be revenue neutral. But after the legislative session, a summary by Bureau of Legislative Research shows an overall increase of state revenue from the legislation of $3 million in Fiscal Year 2018 and $5.9 million in Fiscal Year 2019.[i] Game over – it is a tax increase.

Let’s put that aside for the moment the BLR estimate and just assume the bill had balanced tax cuts and tax increases. Can you say the bill is not a tax increase when most people will only see an increase in their taxes?

Military retirees had worked long and hard to gain the tax exemption. After all, a number of other states gave their military retirees the same exemption. Yet some military retirees came away from the process embarrassed and feeling used by the Governor and legislators. The tax increases in the bill meant their comrades who did not stay in the military long enough to qualify for retirement pay were going to pay more taxes. Low income citizens would get hit by more taxes and the public in general would be paying more.

Do you buy the claim of politicians that it is not a tax increase when your taxes go up to fund tax relief for someone else? What if the “someone else” was not military retirees but some business fat cat? Would you think the bill wasn’t a tax increase when your taxes go up?

Politicians pick the winners and losers. Most of the state were losers… because of the tax INCREASE.

II. CLAIM: It is not a tax increase because we called it a “fee.”

House Bill 1267 (Act 317) by Representative Lanny Fite increased the tax on new tires by $1.00 and imposed a new tax of $1.00 on used tires. The bill calls it a “fee.”

What is the difference between a “tax” and a “fee”? These days there is often no difference. You may think of a fee being for a service or privilege. Either way, state government taxes more of your money. A rose by any other name….

Oh, and what was the reason for the new tax? To grow government by tracking motor vehicle tires through each step of their life cycle of use to reprocessing.

III. CLAIM: It is not a tax increase because there is an existing tax that has never been enforceable on these transactions.

Senate Bill 140 by Senator Jake Files would have imposed a sales and use tax when you purchase goods from out-of-state sellers. People called it the internet sales tax bill. Tax supporters claimed it is not a new tax because you should be reporting your out-of-state purchases to the state and paying an Arkansas use tax. On most items, the sales tax and use tax has never been enforceable on out-of-state purchases. Unenforceable in Arkansas and unenforceable in other states.

The sponsor claimed the bill might generate $100 million in new tax revenue for the state. That is an additional $100 million out of the pocket of Arkansas taxpayers. Game over -it was to be tax increase.

IV. CLAIM: It is not a tax increase because we are only authorizing the voters to pass the tax, but not telling them that is what their vote will do.

House Bill 1726 by Representative Dan Douglas was part of a two-bill plan to increase gasoline and diesel taxes to fund highway bonds. This bill would have put on the ballot a proposal to authorize new highway bonds, but the proposal would not tell voters a vote “FOR” would trigger an increase in gasoline and diesel taxes. The tax increase was in House Bill 1727 and it said the tax only applied if the bond issue was approved. Both bills had to pass for the plan to work.

The plan was to pass the bills and then for legislators to say “No, we didn’t raise taxes, the people will decide to impose the tax on themselves at the election.” And…. Most voters would not realize the vote increased their taxes.

Douglas’ bills did not pass. Make no mistake – those who voted for the bill were seeking to raise gasoline and diesel taxes.

Misdirection, Deception, and Semantics – Why have theses become the primary tools in the legislature’s political tool chest?

[i] “General Revenue Estimated Impacts of the 91st General Assembly, 2017 Regular Session,” 2017 Summary of Fiscal Legislation, Bureau of Legislative Research