The Conservative Budget Deception

A news release from the Arkansas House of Representatives said:

“One of the last bills we passed was the amendment to the Revenue Stabilization Act. This outlines the $5.7 billion budget for Fiscal Year 2020. It includes a 2.2% increase in spending from the current fiscal year. It is the lowest amount of increased spending in Arkansas in the last 10 years.”

The message here is, “Look what a great job we are doing to hold down state spending.” And, of course many legislators were quick to repeat the good news on their Facebook and Twitter accounts, and in speeches to community groups.

BUT, if you think the news release is saying overall state spending has been held down…. you have been badly fooled by the carefully crafted words of politicians.

It is not saying the total state budget is only $5.7 billion, nor is it saying the total state budget was only increased by 2.2%.

Using carefully crafted wording, the statement actually only refers to that portion of the state budget covered under the Revenue Stabilization Act (RSA). The RSA act distributes “Net Available General Revenue,” AND General Revenue is only one of several big piles of money from which state programs are funded.

Crafty politicians want you to focus only on one piece of the budget puzzle (General Revenue), not the whole budget picture.

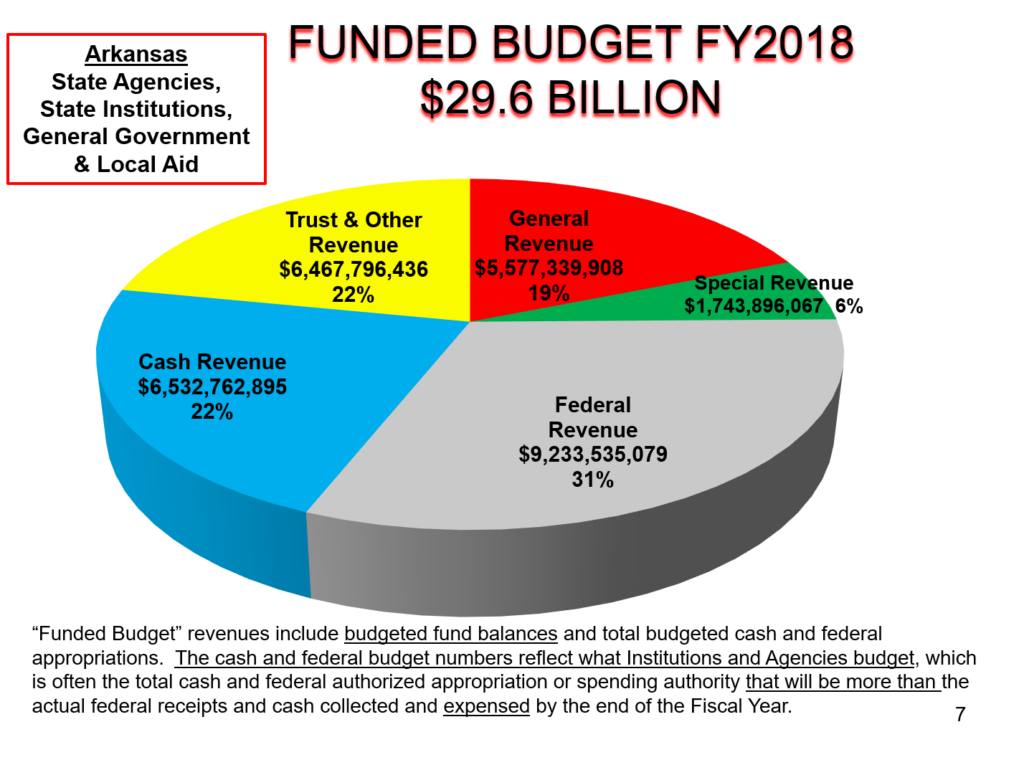

General Revenue is only about 27% of state funds spent through the state budget. When you include federal funds received by the state, General Revenue is only about 19% of the state budget.[i]

So… when someone brags how they held the General Revenue Budget to a 2.2% increase, you may want to respond,

“Well done, but now tell us about the remaining 81% of the budget.!”

Where Does The Other 81% Of The Budget Come From?

If General Revenue has been about 19% of the state budget, what about the other 81%? In addition to General Revenue distributed through RSA, the state budget includes Dedicated Sources and One Time Funding.

- Dedicated sources include: Special Revenue, Federal Funds, Cash Funds, and Trust Funds.

- One Time Funding includes: Surplus and Recouped General Revenue.[ii]

The chart below was prepared by the Bureau of Legislative Research. It should help in understanding the state budget and show how General Revenue distribution is only one slice of the pie. The chart is of the funded budget for Fiscal Year 2018.

What Happens When General Revenue Spending Is Held Down?

It is a good thing when politicians hold down spending from General Revenues. Well, at least it is better than spending it all immediately.

When General Revenue spending is held in check it doesn’t rule out increases in spending from other state funds.

Did you know that General Revenue not spent gets rolled over into other state funds, such as a surplus funds, and then spent. One day it is General Revenue and … poof… the next it is spent as some other kind of fund.

Breaking The Cycle of Misdirection

Bragging on General Revenue spending (despite it being only a small fraction of overall state spending) is something both Republican and Democrat politicians have done for a long time.

Up until now only a few legislators have dared try to remove the veil from the bogus narrative of conservative budget success, but we hope the tide is changing and more legislators will insist on the public being given the full picture of Arkansas’ big spending. We hope some legislators will insist on managing all of Arkansas’s spending, not just General Revenue spending.

Spending reform will not happen in Arkansas until politicians quit acting like they are only responsible for General Revenues.

[i] Financing & State Programs, a PowerPoint by Bureau of Legislative Research – Slide 7, Funded Budget FY2018

[ii] Financing & State Programs, a PowerPoint by Bureau of Legislative Research – Slide 9 – Methods of Funding Available