91st General Assembly Fact Sheet – Help Your Legislator Stand for Economic Freedom and Liberty

The 91st General Assembly has wound down and legislators will be going back to their districts to give “reports” on the legislative session. These legislators will likely attend party committee meetings, chamber of commerce events, civic clubs, and other opportunities to give their take on the recent legislative session. Many legislators will discuss legislation they sponsored and other significant bills that may be included here. This “Fact Sheet” will give people attending these events the information to ask questions and have the full picture on a bill or topic of the session. Conduit for Action tracked the legislative session everyday so that they could keep the taxpayers informed on the whole story.

You can print off a PDF Version of this Fact Sheet to take with you to your events where legislators will be.

Taxes

What a Legislator Might Tell You: We cut taxes by $50 million. We cut taxes for low-income persons and for military retirees.

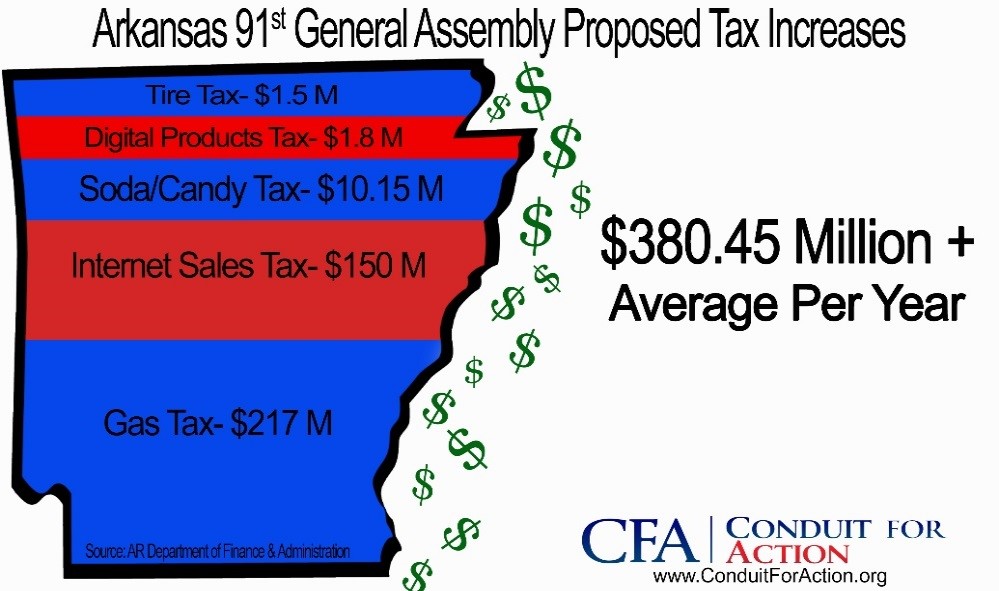

What a Legislator Might Not Tell You: They did cut taxes on those making $21,000 or less a year, but raised taxes elsewhere and tried to raise even more taxes which were narrowly defeated. While some in Arkansas will see a small decrease in taxes after this session (those making less than $21K and military retirees), the vast majority of Arkansans will see a net tax increase, with an even larger increase attempted and supported by the Governor. There will be a $1.5 million a year tax increase from used/new tires. There will be a brand-new tax on digital products, bringing in an average estimate of $1.8 million a year. An increase of the sales tax on candy/soda will be a tax increase of an average of $10.15 million annually. Other tax increases that were proposed and supported by the governor included an Internet Sales Tax estimated to possibly bring in up to $150 million annually in new revenue and the gas tax increase proposal which would bring in an estimated $217 million annually.

Although the Gas Tax Hike and Internet Sales Tax were defeated, the Governor has promised to keep pushing for their passage in a future session. Ask your legislator to COMMIT to standing against these taxes.

Government Spending

What a Legislator Might Tell You: We made government more efficient and saved taxpayers money.

What a Legislator Might Not Tell You: They increased government spending by $163 million, with an increase of $113 million going to the Department of Human Services which oversees Medicaid Expansion. Medicaid Expansion is the giving of health insurance to able-bodied, working age adults which does not include the elderly or children. Medicaid Expansion in Arkansas was made possible through the Affordable Care Act, also known as Obamacare. The Medicaid Expansion program, previously called the Private Option and now called Arkansas Works, has a budget of $1.82 billion, with the state covering $109 million of that amount.

Job Growth & Economic Development

What a Legislator Might Tell You: This was a great session for job growth and economic development. We granted more tax credits to Big River Steel Company for expanded economic development.

What a Legislator Might Not Tell You: There was no true broad-based regulatory or tax reform to truly unleash economic development. One piece of legislation that was passed and billed as “economic development” was SB688, which expanded tax credits for Big River Steel company. This corporate welfare program would lead to an increase of $11 million in tax credits for this company. Although many champion giving millions and billions of taxpayer money to private businesses, this is not truly an economic development tool. What occurs is that the “jobs created” are actually just jobs shifted from other companies who do not receive any special help from the government. Tax dollars from businesses are taken from them and then given to other private businesses with whom they then have to compete.

What they also might not tell you is about HB1551 filed by Rep. Richard Womack seemly envisioned to guard against excessive occupational licensing (which hinders job growth and economic development.) That bill did not make it out of committee. It was a bill based on principle worth further study. It was disappointing that the legislature even voted down a resolution to add a subcommittee to study current licensing in Arkansas. Another reform measure by Sen. Linda Collins-Smith, SB512, would have required state agencies to repeal at least one rule/regulation for each new rule/regulation they propose. This was similar to President Trump’s executive order on repealing two regulations at the federal level before a new one could be proposed. This regulation reform measure failed on the Senate floor.

It appears that small business in Arkansas needs to do a better job educating and keeping their legislator informed as to what they need from government. Government does not create jobs! Small business in Arkansas left alone by the government creates jobs!

2017 Specific Bills:

HB1162 (now Act 141) (Rep. Charlene Fite / Sen. Jane English) – Military Retirees Income Tax Exemption with Tax Increases

What a Legislator Might Tell You: They cut taxes for military retirees. This is true. Military retirees received an income tax exemption under this law.

What a Legislator Might Not Tell You: There is much more in this Act than just a tax cut for military retirees. Instead of cutting spending in government to offset the tax cut, the general assembly raised taxes other places and created a brand-new tax on digital products (music, movies, e-books, etc.). They raised taxes on the people at the retail level on soda and candy, while giving a tax cut at the wholesale level for soda companies producing the soda. They also began taxing unemployment compensation in the bill to increase revenue. (Also, a designated amount from the tax increases will be set aside annually to fund the Medicaid Trust Fund.) So, while military retirees gained an income tax exemption, the vast majority of Arkansans (including veterans without military retirement) saw a net increase in taxes under this bill. Some legislators even accused those who preferred cutting government spending instead of raising taxes elsewhere as not supporting the troops.

SB140 (Sen. Jake Files / Rep. Dan Douglas) – Internet Sales Tax (Passed Senate, Failed on House Floor 43-50)

What a Legislator Might Tell You: This is not a tax increase or a new tax. This is a law on the books and we are just enforcing it. This will save Mom and Pop shops. This is about fairness. This is constitutional. Well, Amazon is paying this tax, so it must be legal.

What a Legislator Might Not Tell You: This bill is blatantly unconstitutional, as admitted by the House sponsor and language within the bill itself under the U.S. Supreme Court case Quill vs. North Dakota. The bill is modeled after a South Dakota bill that was just struck down as unconstitutional. The bill would result in an increased collection of taxes of between $50 -$150 million a year on online purchases. Currently, there is a use tax on the books, but there is no internet sales tax. The bill would shift the use tax into an online sales tax, leading to increased taxes and revenues and a new sales tax on online purchases. Interstate commerce is within the purview of the U.S. Congress as established under the Commerce Clause of the U.S. Constitution. The bill does nothing to help local businesses with a better tax and regulatory environment but simply increases tax collections elsewhere, therefore not benefitting and “saving Mom and Pop shops.” People will still continue purchasing online, but just have less money with which to do so. There was no offset in the bill or any directing of the new revenue to a particular purpose. The bill asks the courts to legislate from the bench and change established US Supreme Court precedent instead of going through the proper legislative branch – the US Congress. Amazon now likely favors an Internet Sales Tax as it would have a disproportionate disparate impact on their smaller e-commerce competitors, thus benefitting Amazon.

HB1726/HB1727 (Rep. Dan Douglas) – Gas Tax Increase Proposal (Failed on House Floor Three Times)

What a Legislator Might Tell You: This is not a tax increase. This is just a bill referring it to the people. This is a tax at the “wholesale level” so it isn’t directly an increase at the gas pump. This is the only way we can pay for repairing dangerously decaying roads.

What a Legislator Might Not Tell You: There are two separate bills that worked in tandem to first levy a 6.5% sales tax on the price per gallon of gas and diesel and second to implement a bond program to issue what could be an unlimited amount of public debt, backed by the general revenues of the state of Arkansas. The tax would not be triggered unless the proposal was voted on by the people. However, the ballot title nowhere tells the people what they actually would be voting on is a tax increase. If passed, the law would have increased prices at the pump an estimated 10 cents per gallon. As with all taxes on large companies, they are passed on to the people. So any notion that this is not a tax increase that will be felt by the people at the pump is off-base. There are several other proposals on using existing taxes from road-use related taxes/fees and/or general revenues.

HB1267 (now Act 317) (Rep. Lanny Fite) – Tire Recycling Program and New/Increases Fees on Tires

What a Legislator Might Tell You: This is not a “tax” increase, this is a “fee” increase. This law will save people from the Zika virus by reducing the number of used tires. This bill is needed because of a used tire epidemic.

What a Legislator Might Not Tell You: This bill increases the new tire rim fee on all new tires from $2.00 to $3.00 per tire and adds a new rim fee of $1.00 for the removal of used tires. The law creates a “commercial generator fee” of $3.00 per tire on commercial generators selling new tires as part of a fleet service. The law creates a new “import” fee of $1.00 per tire on all used tires brought into the state. The bill will create a new “tire tracking system” that will track tires in Arkansas from cradle to grave. This new system will likely cost the taxpayer hundreds of thousands or millions of dollars in the long term to the benefit of the company who gets this new government contract. According to the Arkansas Department of Health there have been zero locally acquired cases of Zika reported in Arkansas. Of the 18 Zika cases reported, they have all been from travel to other countries/states, and therefore none acquired because of used tires in Arkansas. The passage of this bill is an example of a government solution looking for a problem.

SB362 (now Act 465) (Sen. Lance Eads / Rep. Andy Davis – Phases Out InvestArk; Ends Sales Tax on Business Inputs

What a Legislator Might Tell You: That this bill creates an “exemption” on the sale of repair parts and business inputs.

What a Legislator Might Not Tell You: A business input is sometimes taxed two to three times before a final product is made and then a sales tax is applied again to that final product. This bill would phase out this double and triple taxation problem. Instead, only the final product would be taxed and the machine and repair parts that make the product would not be taxed. This bill also phases out the InvestArk corporate welfare program. This bill levels the playing field and treats all business inputs and businesses equally regardless of their size.

HB1222/SB746 (Rep. Jim Dotson / Sen. Bart Hester) – School Choice/Education Savings Account (HB1222 Failed in House; SB746 Passed Senate, Failed in House)

What a Legislator Might Tell You: This will hurt public schools. This uses taxpayer money and gives it to private schools. This is a voucher program. This only helps rich people.

What a Legislator Might Not Tell You: This is just a pilot program to test school choice and educational savings accounts (ESA). The ESAs would be funded with private money donations and given to students to use for the educational setting that is best for the individual child. Those donations will have a 65% match rate for a tax credit. Many students who might do better in a non-traditional public school may be unable to do so due to money. This will would open up educational opportunities to the less fortunate throughout Arkansas as they receive priority status for the ESAs. There is a cap of 1% of eligible students enrolled in a public school. For every private school student who receives an ESA, there must be two public school students to receive an ESA. There are no “vouchers” given, only privately funded education savings accounts. The bill does not hurt public schools, but instead incentivizes them to be the best they can be or students may look elsewhere for a better educational opportunity.

HB1465 (Rep. Josh Miller) – Medicaid Expansion (Obamacare) Enrollment Freeze (Passed the House; Failed in Senate Public Health Committee)

What a Legislator Might Tell You: We have to wait and have a special session to address Obamacare Medicaid Expansion. This is not the right approach. This puts a cap on Medicaid Expansion. This will cost the state money.

What a Legislator Might Not Tell You: This bill would have simply frozen enrollment on the Obamacare Medicaid Expansion program originally called the Private Option and now called Arkansas Works. No person on the program would be thrown off the program under this bill. Only new applicants would be prohibited from applying. Those currently on the program would still be able to re-apply. Therefore, there was no cap set under this bill. There has been a consistent argument by supporters of Obamacare Medicaid Expansion that signing up able-bodied, working age adults for health insurance provided by the taxpayers would somehow save the taxpayers money. This is still not been proven correct; yet opponents of this enrollment freeze bill continued to argue that not allowing new people to sign up for the program would cost the state money. Original estimates state that no more than 215,000 people would ever sign up for the program. Currently over 320,000 are on the program and it continues to grow. The budget chairman and conservative Republicans have long stated the program is not sustainable, and this bill would at least stop the bleeding until we know what will happen at the federal level with Obamacare. The Governor wants to have a special session to address Medicaid Expansion, but this would have been a good bill to get a clear picture of where the state will have to go moving forward.

SB175 (Sen. Bryan King) – Medicaid Disclosure Bill (Passed the Senate; Failed in House Committee)

What a Legislator Might Tell You: This is a broad, big government bill but also it does not go far enough (actual argument from one State Rep). This puts too heavy a burden on DHS. The disclosure isn’t fair because it would require government officials to also disclose transactions involving their spouses and employees of their businesses.

What a Legislator Might Not Tell You: The bill requires disclosure by Medicaid providers and government officials of transactions between the two that are in excess of $2,000 annually. It also requires disclosure by Medicaid providers of compensation amounts paid to lobbyists to see how much money they spent to get billions of taxpayers’ money. There is an exemption for disclosure of transactions for patient care involving Medicaid. The bill would simply require DHS to create a form for the disclosure, alert the Medicaid providers of the disclosure, and then accept the disclosure form when mailed in. The bill should not create a heavy burden or unfunded mandate on DHS. DHS received an appropriation for $8.3 billion. Surely some of that $8.3 billion could be used for these clerical tasks. This bill would have simply provided for more transparency and disclosure in an industry in which taxpayer money is funneled through by the billions.

SB726 (Sen. Collins-Smith) – Ethics Bill to Close Loophole Allowing Attorneys/Consultants to Make Laws for Clients (Failed on Senate Floor)

What a Legislator Might Tell You: This bill would prohibit attorneys/consultants in the legislature from making a living. There is already a law on the books for this. This is an attack on attorneys and consultants.

What a Legislator Might Not Tell You: The bill prevents attorneys or consultants from receiving compensation and then filing/running bills for their clients. While there is currently a prohibition against legislators “lobbying” for compensation from clients, there is a potential for a loophole to get around this prohibition. An attorney/consultant may simply contract out any “lobbying” services between them and a client. Then the attorney/consultant could “receive compensation” for the drafting of a bill and filing of a bill, but the “lobbying” is just in their normal role as a legislator and specifically not part of the “compensation” they receive from their client. SB726 made it clear that this conduct of being paid to file/run/consult on bills for a client is prohibited and closes any loopholes to get around the current ethics laws.

You Can Check your Legislator’s Voting Record on each bill online at:

http://www.arkleg.state.ar.us/assembly/2017/2017R/Pages/Home.aspx