Clarification Needed From Arkansas Republicans. Please respond.

The Republican Party of Arkansas includes this principle in its platform: “LOWER TAXES TO PRODUCE ECONOMIC GROWTH.”

The Republican Party of Arkansas includes this principle in its platform: “LOWER TAXES TO PRODUCE ECONOMIC GROWTH.”

We thought that was an easy principle to understand. We thought it meant lowering the overall tax burden on all Arkansans.

But, based on the actions of Governor Asa Hutchinson and the voting record of many Republicans in the legislature, either the principle doesn’t mean what we think or politicians are ignoring this principle.

While the legislature has passed tax reductions for some groups of taxpayers, the legislature has been even busier passing taxes to take tax relief back and to increase the burden on most taxpayers.

- New laws have been passed to increase taxes on gasoline, diesel fuel, your cell phone service, and cigarettes and other items.

- The legislature is putting a proposed amendment to the constitution on the 2020 ballot to impose a permanent ½% sales tax when a temporary ½% sales tax expires in 2023.

- The Senate has passed an internet sales tax on your purchases from out-of-state stores.

- The House of Representatives has passed a proposal to increase water system taxes added to your water bill, and there are other tax increase proposals being championed by …. Republicans.

A Republican bill to give you a small increase in the homestead property tax credit got sidetracked by leadership. A new bill that passed the Senate still lets you have a small increase in the credit but leadership put a rider on the bill to raid much of the surplus in the Property Tax Relief Trust Fund and use it for something other than property tax relief.

Yes, there has been some good legislation and legislators deserve credit …. if that was all they did, but the good has been outweighed by the bad.

If you dig a hole but spend half your time putting dirt back in you aren’t going to get anywhere. The same is true of reducing taxes while increasing taxes.

If you are an Arkansas Republican, your party platform includes the principle “lower taxes to produce economic growth.” What does that mean to you? Does it mean lower taxes for some Arkansans and increased taxes on everyone else? Is it merely a vague suggestion?

We want to hear what Republican voters think the principle means. We are especially interested in hearing from officers of the state party, the platform committee, and members of the Republican county committees.

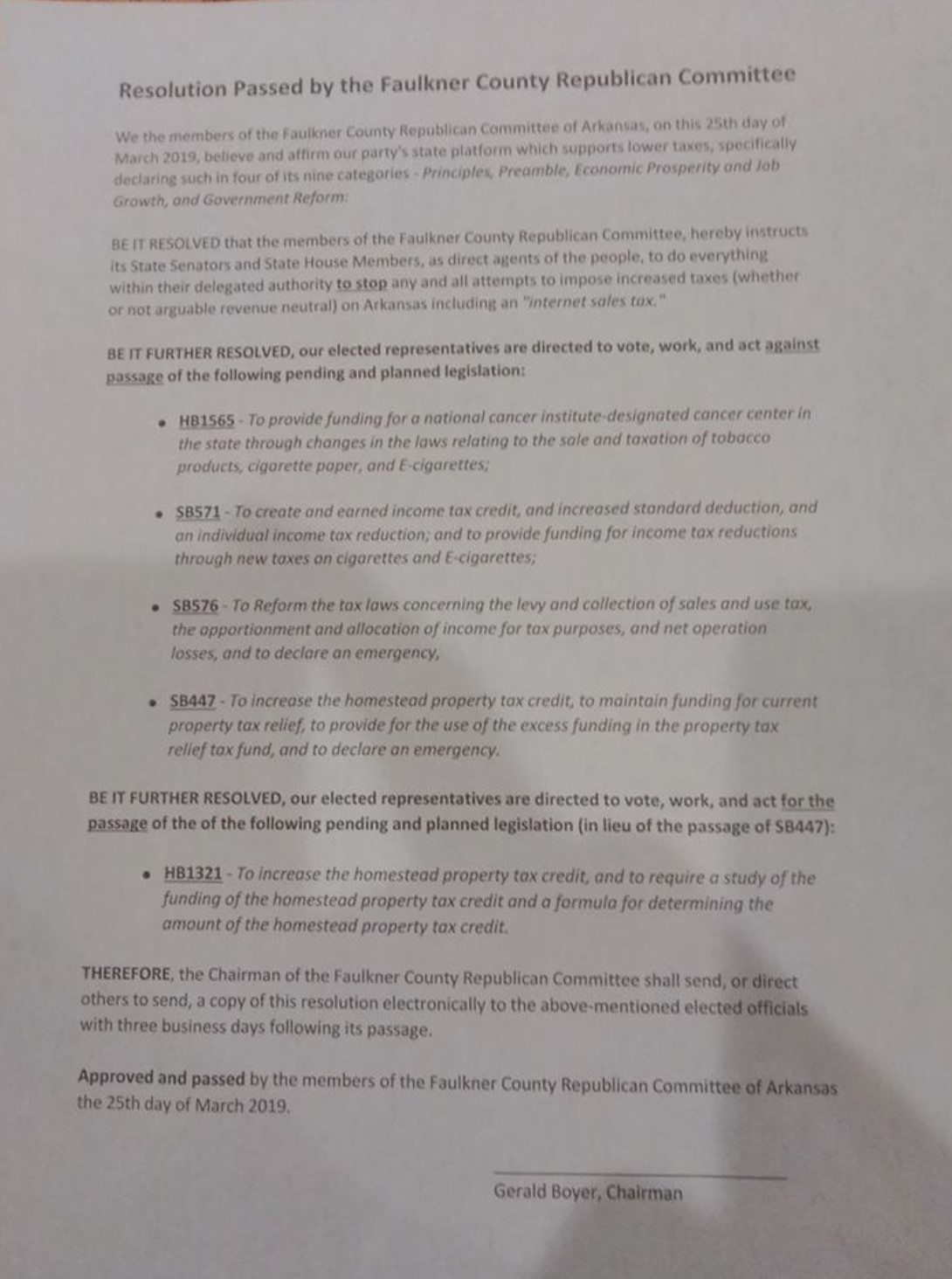

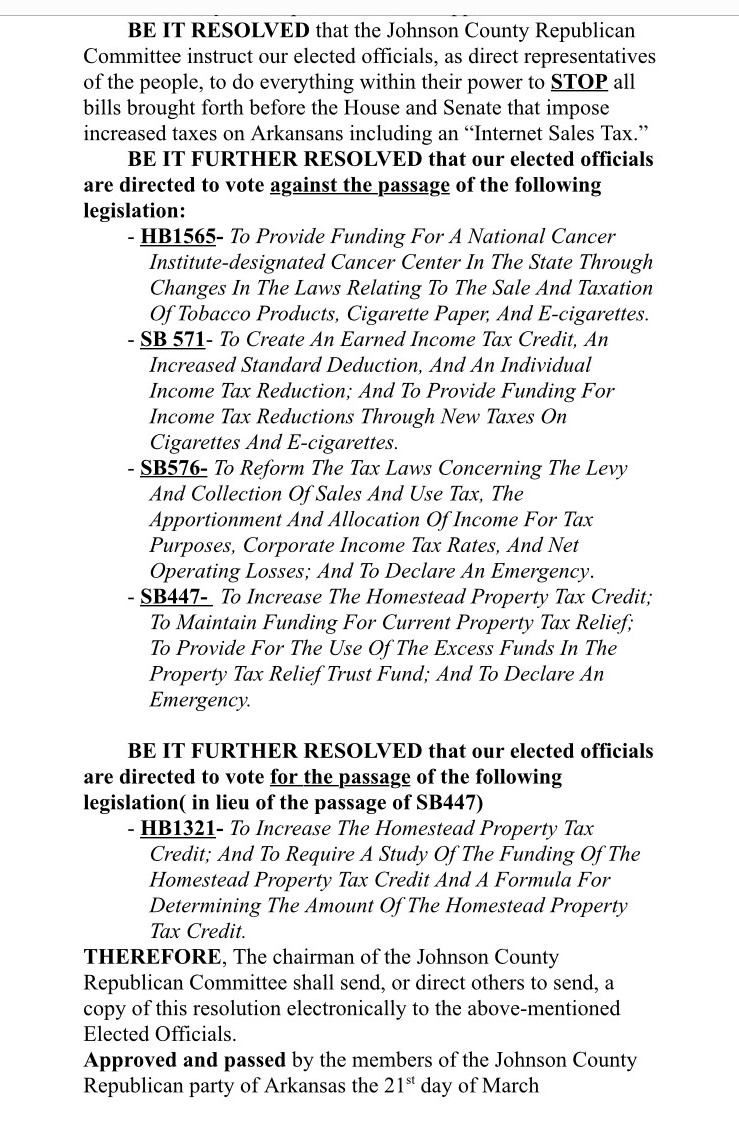

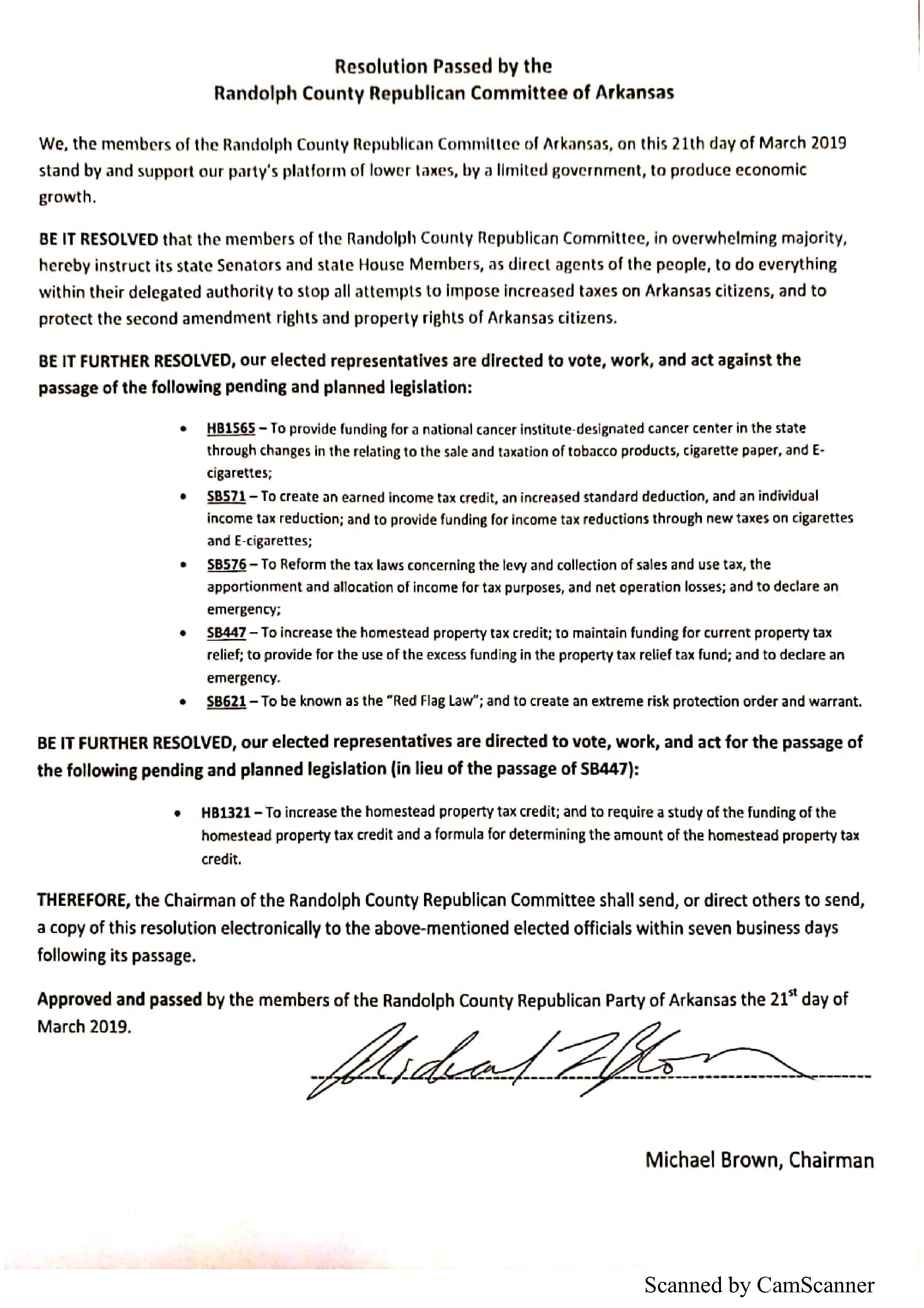

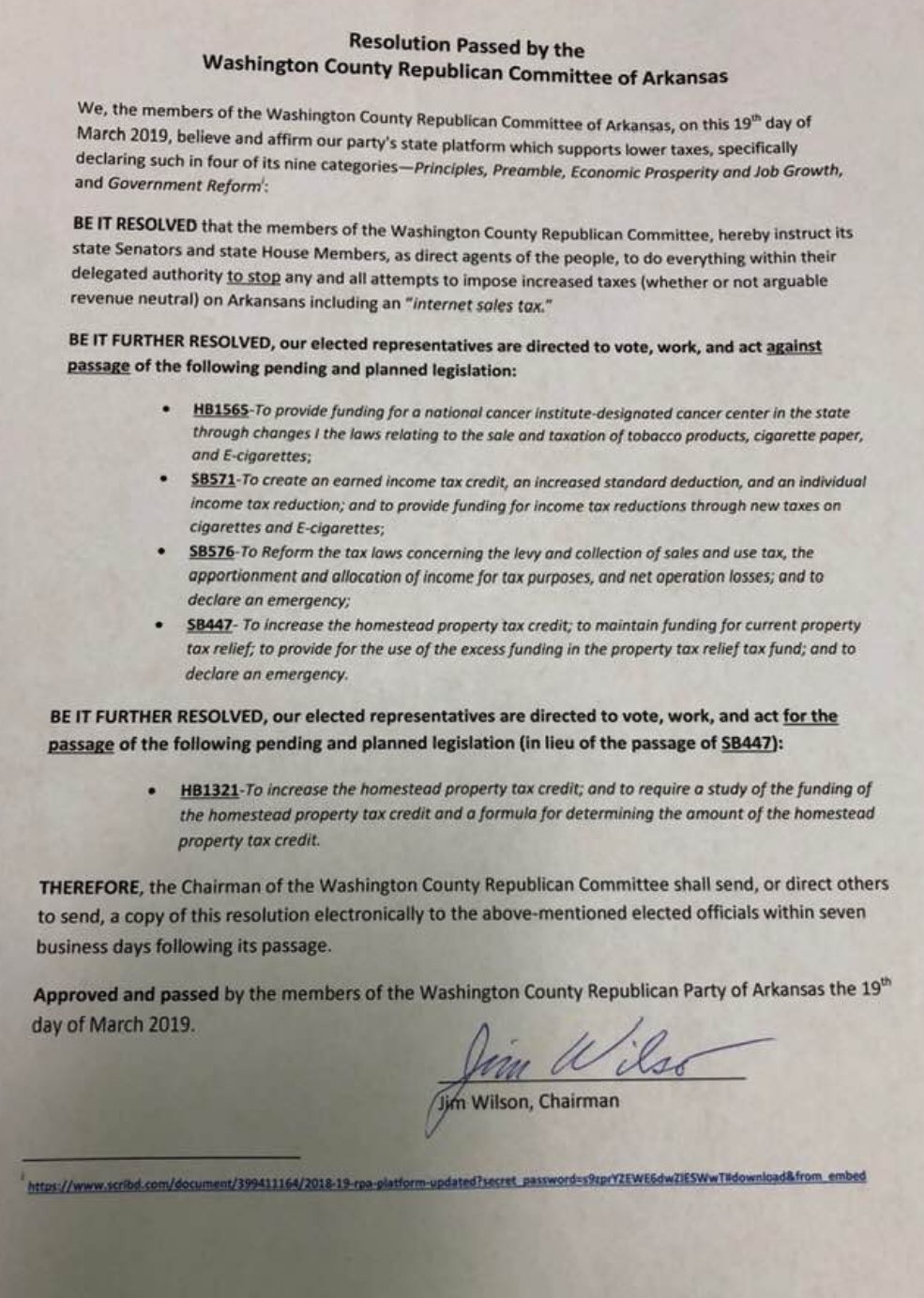

Republican County Committees in Faulkner, Johnson, Randolph, and Washington County have spoken by passing resolutions opposing several bills that include tax increases. (The resolutions appear at the bottom of this article)

A staunch minority of Republican legislators have been battling to stop wasteful spending and to stop tax increases. If you are like minded, they need your help because they are being bombarded from all sides, by the Governor, by big government legislators in their own party, by Democrats, by bureaucrats, and by lobbyists for special interests.

Arkansas taxes are high. The cost of state government per person is one of the highest in the nation. Arkansas is not just surrounded by states with lower taxes, Arkansas’ tax system is worse than nearly every other state.

It is a goal of Conduit for Action to reduce the overall tax burden on Arkansans. Therefore, we thank all of the legislators who stood against the crowd and said “No” to new taxes.

The Arkansas legislative session is nearing an end. If you don’t tell your Representative and Senator what you think of adding taxes, more will be passed.

And the Governor and legislators will brag on the tax reductions while avoiding taking responsibility for the many tax increases. Is that what you meant when the Republican Party of Arkansas adopted the principle which says: “lower taxes to produce economic growth.”

RESOLUTIONS FROM

REPUBLICAN COMMITTEES IN

FAULKNER, JOHNSON, RANDOLPH, AND WASHINGTON COUNTIES